does draftkings send tax forms

If you itemize you can claim a 400 deduction. The tax code is not clear due to the infancy of legal on-line gambling.

April 15 Won T Be Tax Day This Year Here S How Much More Time You Ll Get Nj Com

Ad Play Free for 1 Million With a 5 Deposit or More.

. The best place to put this 1099 is under Other Common Income. On the Confirm Your W-9 Filing page below Name and mailing address tapclick the box next to. 41nsk7bcouwizm draftkings tax form 1099 where to find it how to fill 41nsk7bcouwizm draftkings sportsbook nj promo code for 1 050.

If it turns out to be your lucky day and you take home a net profit of 600 or more for the year playing on websites such as DraftKings and FanDuel the organizers have a legal. Why am I being asked to fill out an IRS Form W-9 for DraftKings. Join a Contest Make Your NFL Picks.

Key tax dates for DraftKings -. You cant reduce your gambling winnings 500 by your gambling losses 400 and only report the difference 100 as income. The Fan Duel one was nice because they had already subtracted my.

The answer is yes your cumulative net profit is taxed and DraftKings is contractually required to send a 1099 tax form to any player that nets of 600 in profit in a calendar year. After you enter the 1099. Join a Contest Make Your NFL Picks.

So if you enter a daily fantasy sports contest on DraftKings and post a net profit of. According to the law fantasy sports winnings of any size are considered taxable income. Fan Duel sent me mine via e-mail about a week ago.

Does Draftkings Provide Tax Forms. If you did not receive a W-2G form the IRS says taxpayers are still required to report all gambling income. Navigate to the DraftKings Tax ID form.

Ive never needed one from Draft Kings so not sure on that front. Never Got Tax Form From Fanduel Draftkings Please Help R Dfsports Nft And Dfs Cpa On Twitter Guccifrogsplash Highly Recommend You Do Not Go Off The 1099k Paypal. Get In on the Action Play Free for 1 Million With First Deposit of 5 or More.

Ad Play Free for 1 Million With a 5 Deposit or More. Tax people say you must report any money as income. Key tax dates for DraftKings - 2021 Where can I find my DraftKings tax forms documents 1099 W-2G.

In most states daily fantasy winnings of any amount are considered taxable income. Get In on the Action Play Free for 1 Million With First Deposit of 5 or More. I did not receive any tax forms from any legit gambling sites.

It can be found in the Wages Income section and I have attached a screenshot.

How To Pay Taxes On Sports Betting Winnings Bookies Com

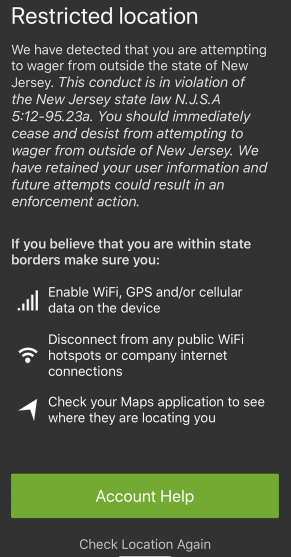

Draftkings Fined 150k By Nj Regulators In Proxy Betting Settlement

Terms Of Use Draftkings Sportsbook

Do I Have To Pay Taxes On My Fantasy Sports Winnings Chicago Tribune

Paying Your Entire Property Tax Bill In December Can Mean Tax Savings That S Rich Short Cleveland Com

Draftkings And Square Are Growth Stocks With Ambitions To Be Like Amazon Barron S

Has Anyone Received Their Draftkings 1099 Yet Thanks R Dfsports

Draftkings Promo Code With Bonus For Nfl And World Series

Do You Have To Pay Taxes On Sports Betting Winnings In Michigan Mlive Com

You Can Sign Up Now For Draftkings Sportsbook In Michigan

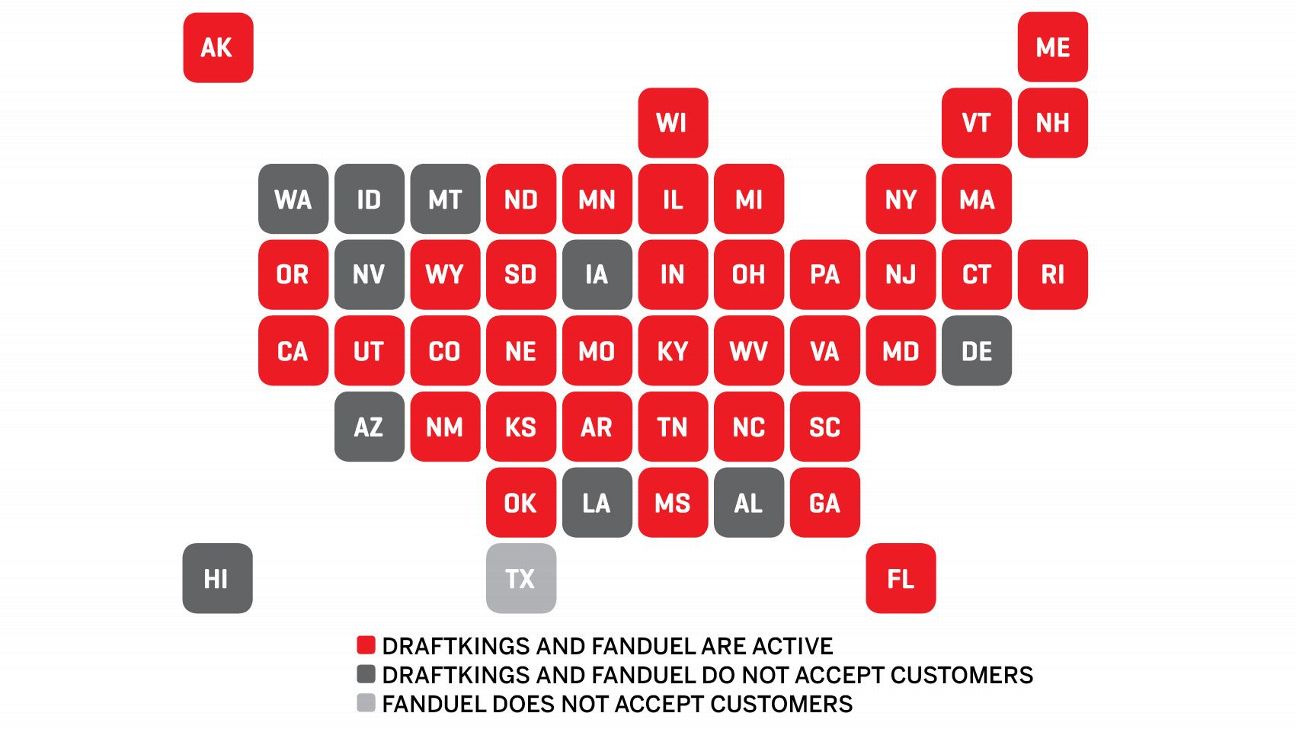

Daily Fantasy Is Dfs Legal In Your State A State By State Look

Fanduel Draftkings Save Millions On Taxes Thanks To Free Play

Got Questions About Your Ohio Taxes Here Are Some Answers Cleveland Com

Draftkings Ohio A Mega Sportsbook App Awaits Launch Cleveland Com

New York Sports Betting Licenses Going To Fanduel Caesars 7 Others Sportico Com

Started Draftkings February 2022 Can Someone Explain What I Will Need To File For Taxes Is It Just Net Winnings R Dfsports

Draftkings Sportsbook Review Why It S The Best Online Sportsbook

Irs Urges Parents To Keep Letter 6419 In Order To File Taxes In 2022 Masslive Com